Bitcoin price action cooled after another rejection at the $113,000 level, even as markets priced in steeper odds of imminent Federal Reserve easing. The move puts Bitcoin price back in focus as traders weigh macro signals and key support.

Rejection at $113K caps rally

According to the source, Bitcoin reached an intraday peak of $113,402 on September 4. However, it failed to hold gains at $113,000. As a result, the price slipped toward the $110,000–$109,000 support band. This zone now acts as a near-term line in the sand for Bitcoin price.

Meanwhile, volatility remained contained despite the rejection. Traders watched whether spot demand would rebuild at support. If momentum returns, the $113,000 area could become a battleground again for Bitcoin price.

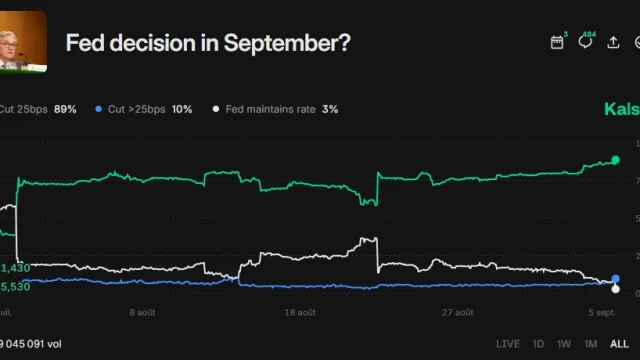

Fed cut expectations intensify

Macro tailwinds strengthened. The CME Fed Watch Tool indicated a 97.6% probability of a rate cut in September. Federal Reserve Governor Chris Waller told CNBC that “rate cuts should begin at the upcoming FOMC meeting,” and he expects multiple cuts over the next three to six months. Therefore, liquidity expectations improved across risk assets, including crypto.

The labor backdrop added fuel. The U.S. economy added only 22,000 jobs in August against an expected 75,000. Moreover, unemployment rose to 4.3%, the highest since October 2021. Consequently, the weak data reinforced expectations for monetary easing and kept Bitcoin price sensitive to macro headlines.

What traders are watching

Key near-term factors for Bitcoin price include:

• Whether the $110,000–$109,000 support holds on closing timeframes.

• Reaction at $113,000 on any retest after the latest rejection.

• FOMC guidance on the pace and size of cuts.

For broader context on how rate cycles can influence digital assets, see this overview from Wikipedia on monetary policy. However, remember that price action can diverge from macro signals in the short term.

Traders also continue to monitor stablecoin flows as a proxy for fresh capital. For a primer, read our guide on how stablecoins work.